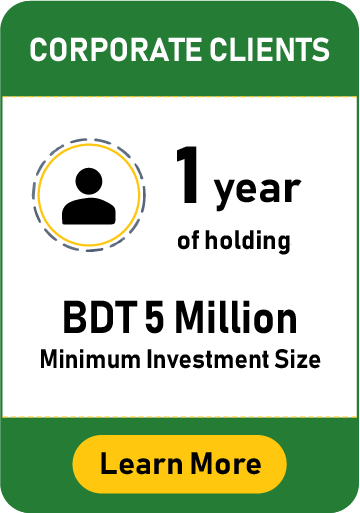

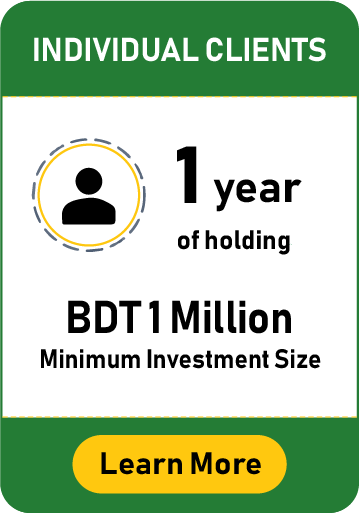

We offer Discretionary Portfolio Management services to both individual and institutional investors. Through our discretionary scheme, we manage investments on behalf of our clients. Our fund managers begin by taking the time to understand client’s unique needs and aspirations, before designing a portfolio to realize those goals with the help of analysis and recommendations from our experienced, knowledgeable investment specialists.

Investors can avail our services through our discretionary investment scheme: GD Perform-Max

Product Snapshot

- Opportunity for clients to get higher return by investment in the stock market.

- Professional management of client’s investment portfolio.

- Continuous monitoring of capital market changes & active management.

- Risk control & portfolio performance reviews on a regular basis.

- Dedicated Relationship manager for Discretionary Portfolio Management Service

- Investors have their consent over taking margin loan; however, the loan ratio will be determined by the PM (Portfolio Manager) based upon the questionnaire data.

- Investors may also have their preference over sector exposure.

- Quarterly reporting of portfolio statements

Product Snapshot

Core Product

GD Perform Max: Discretionary Portfolio Management Scheme

Utilize the fund of risk taker who likes to invest in Equity market particularly in the High Growth stocks to earn more.

GD Planner: Discretionary Portfolio Management Scheme

Deposit of Small Amount with in a regular interval & let investment savings grow with GDCL.